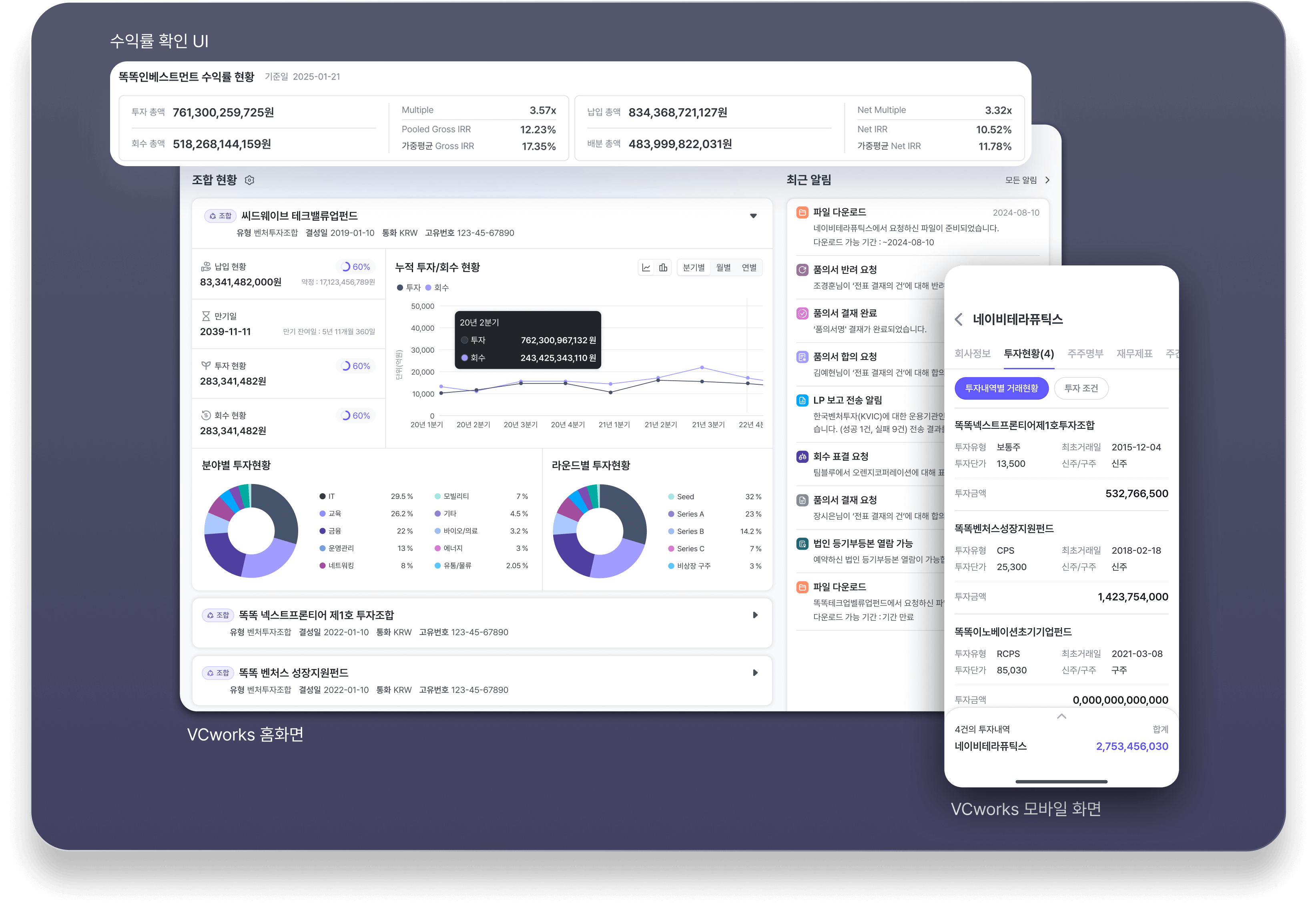

Innovation in Investment Asset Management

" Opening the Era of Intelligent Investment Asset Management with DDOCK "

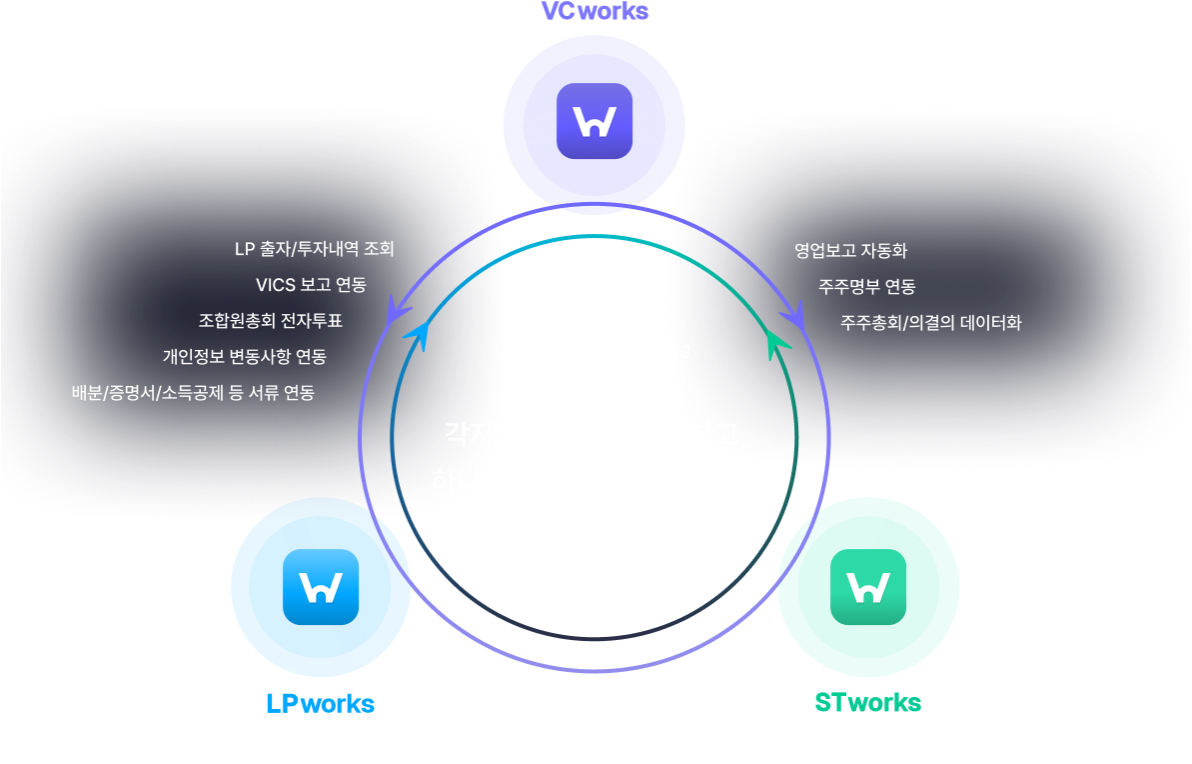

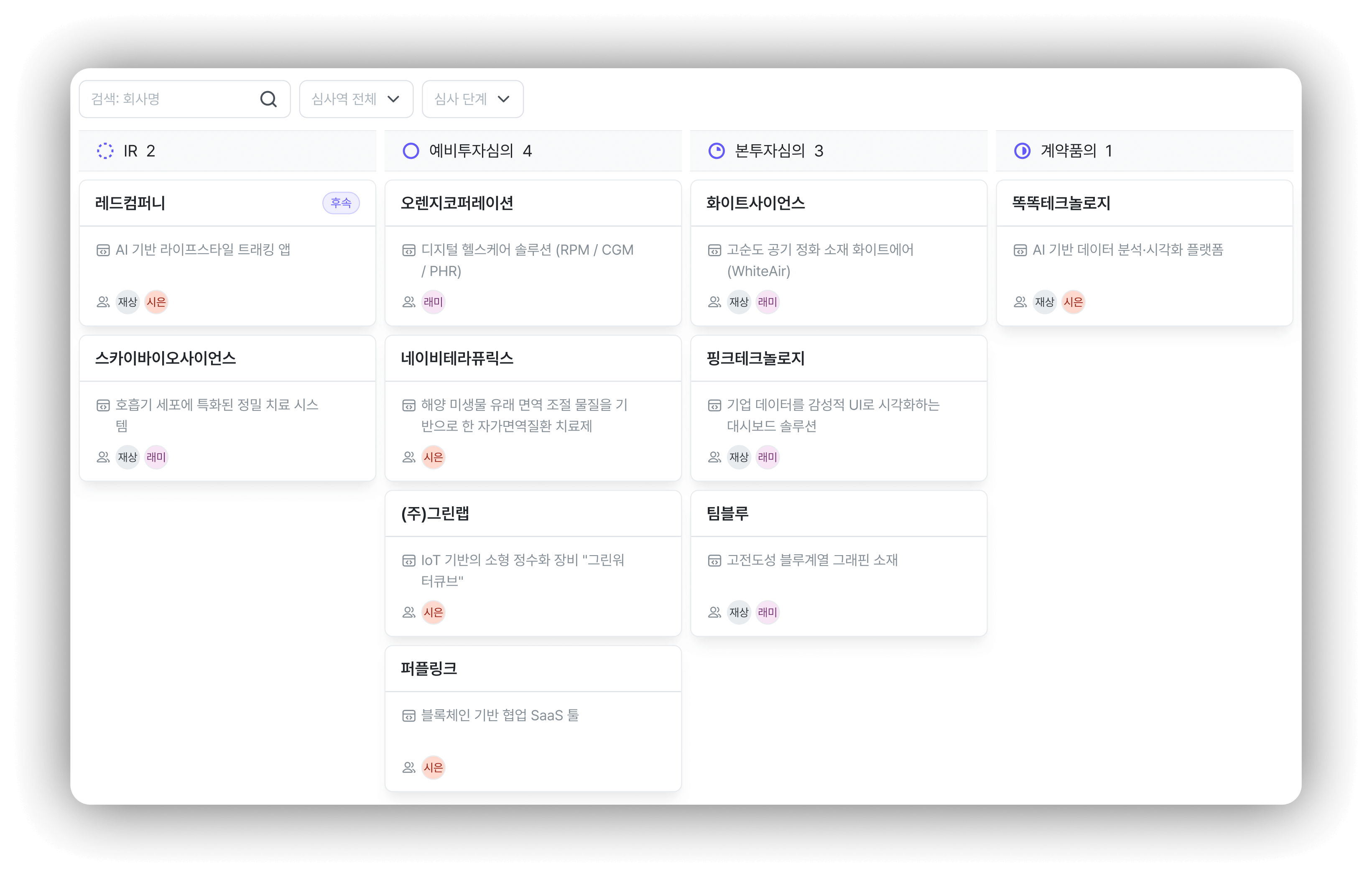

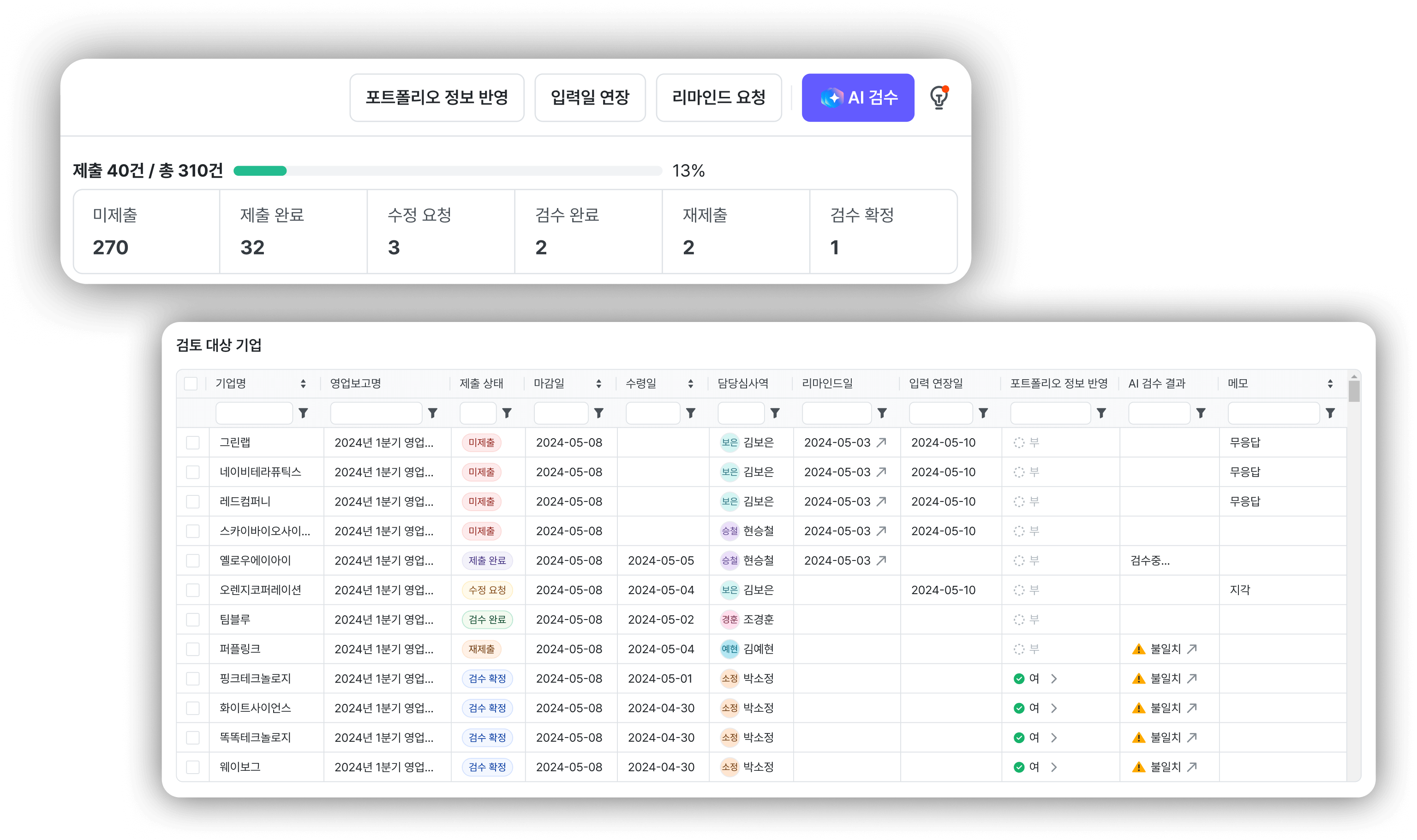

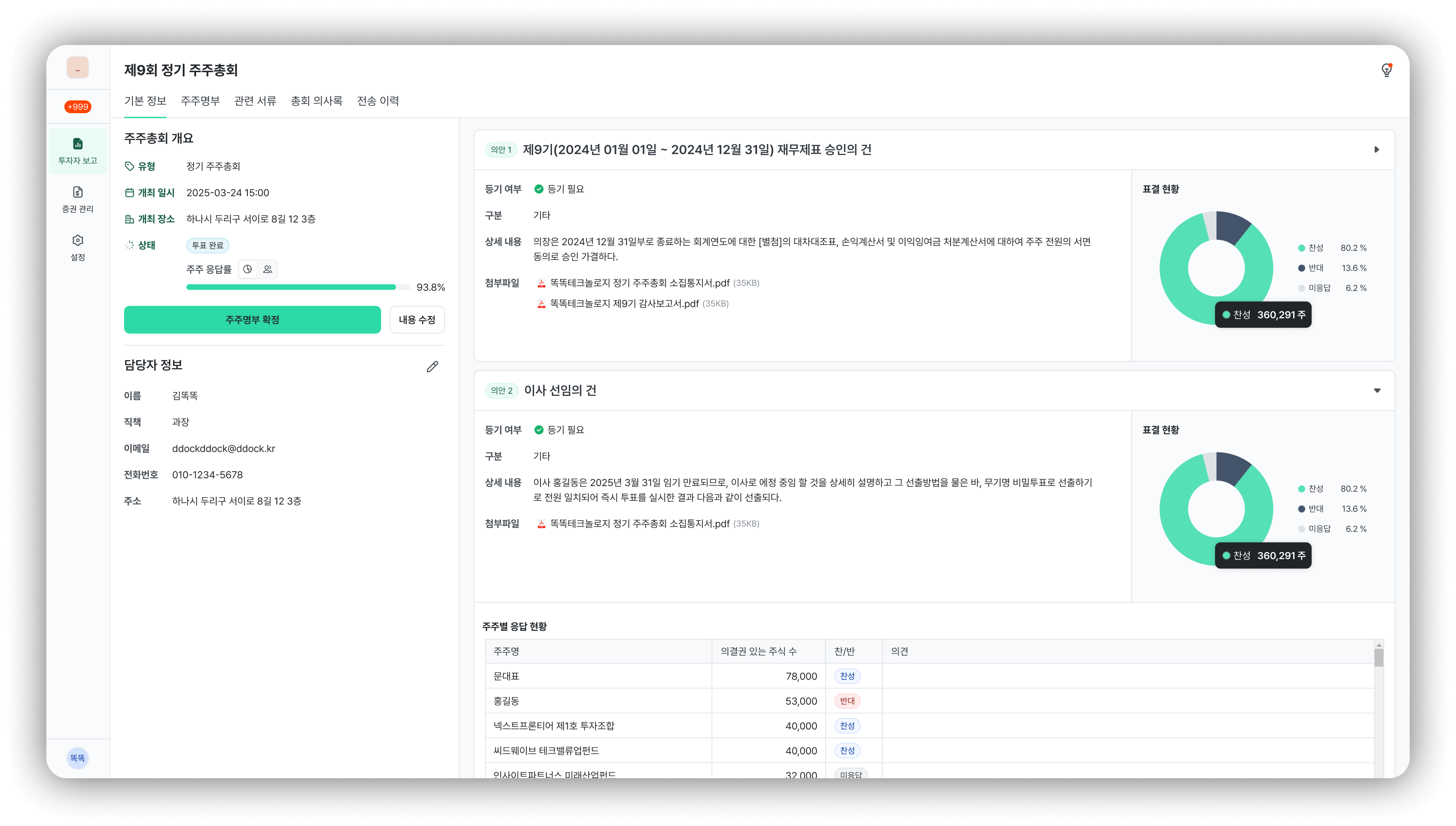

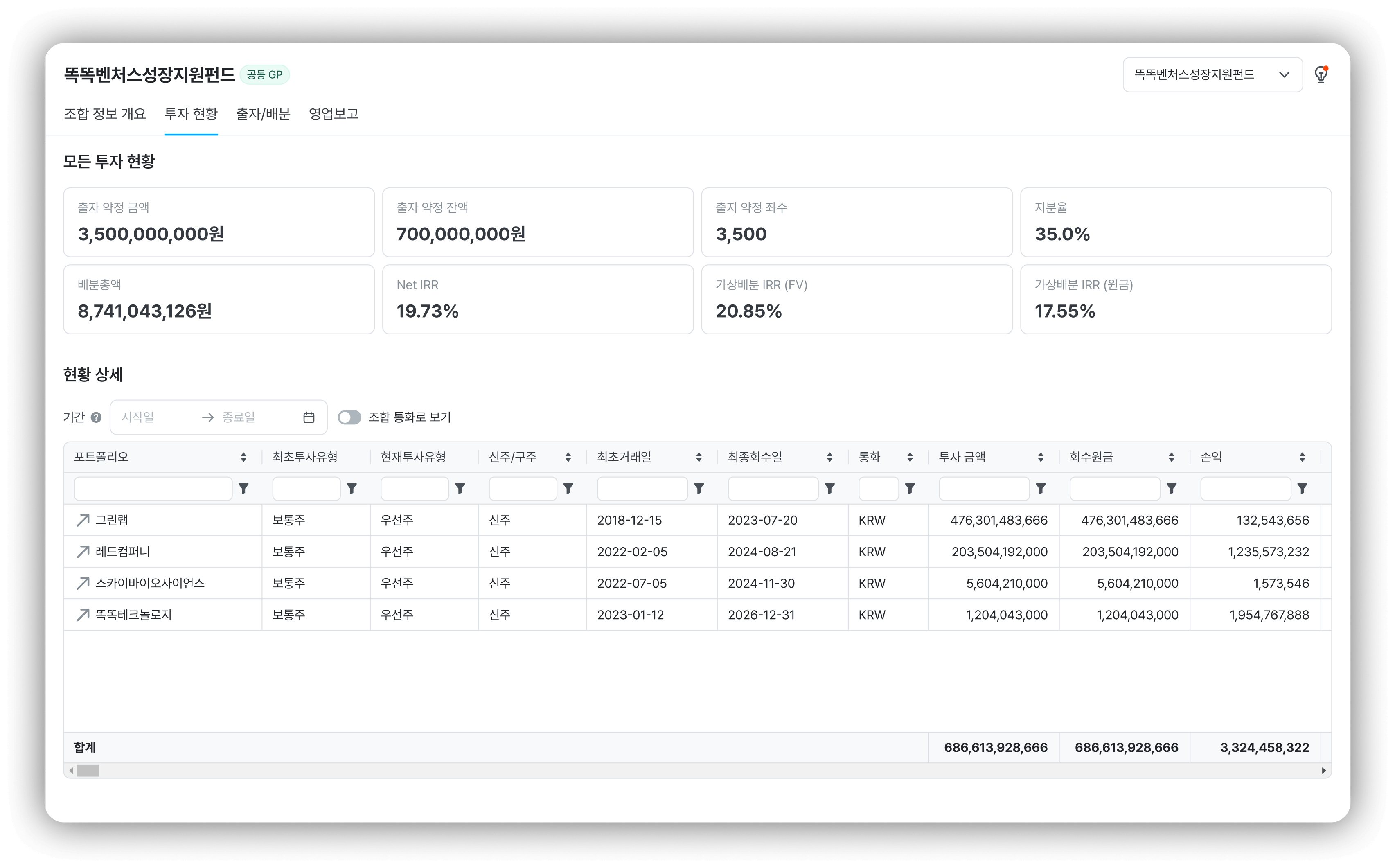

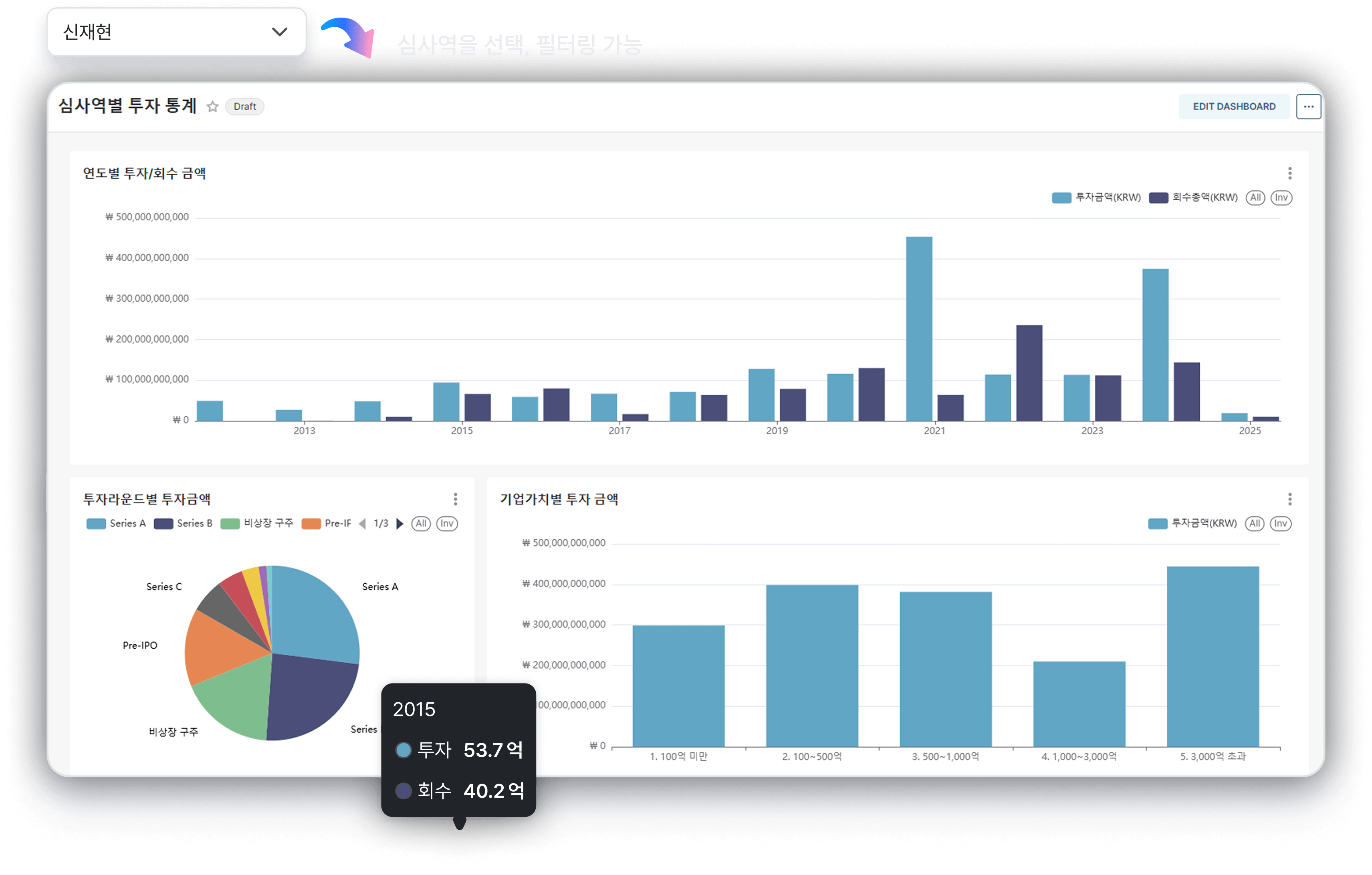

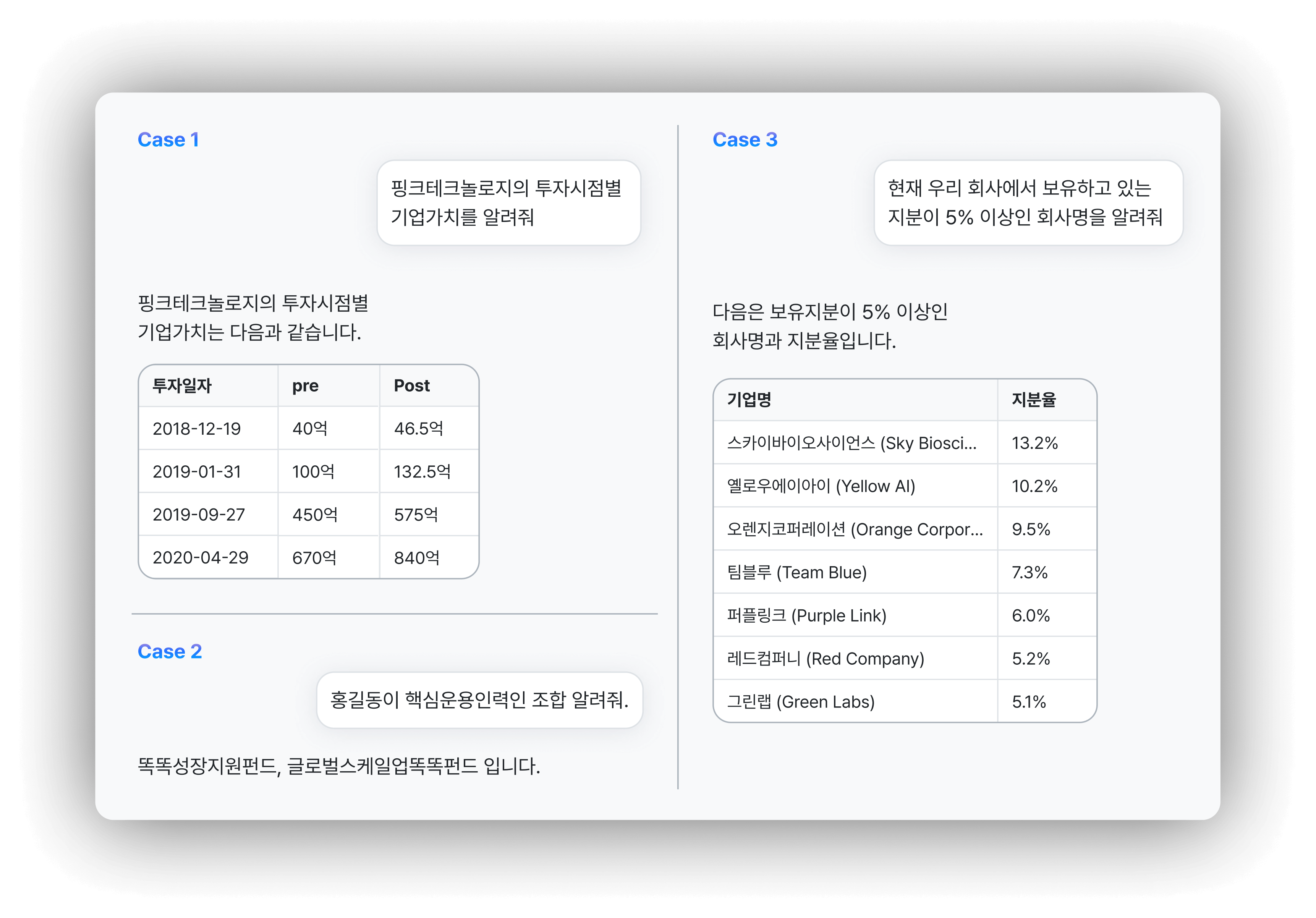

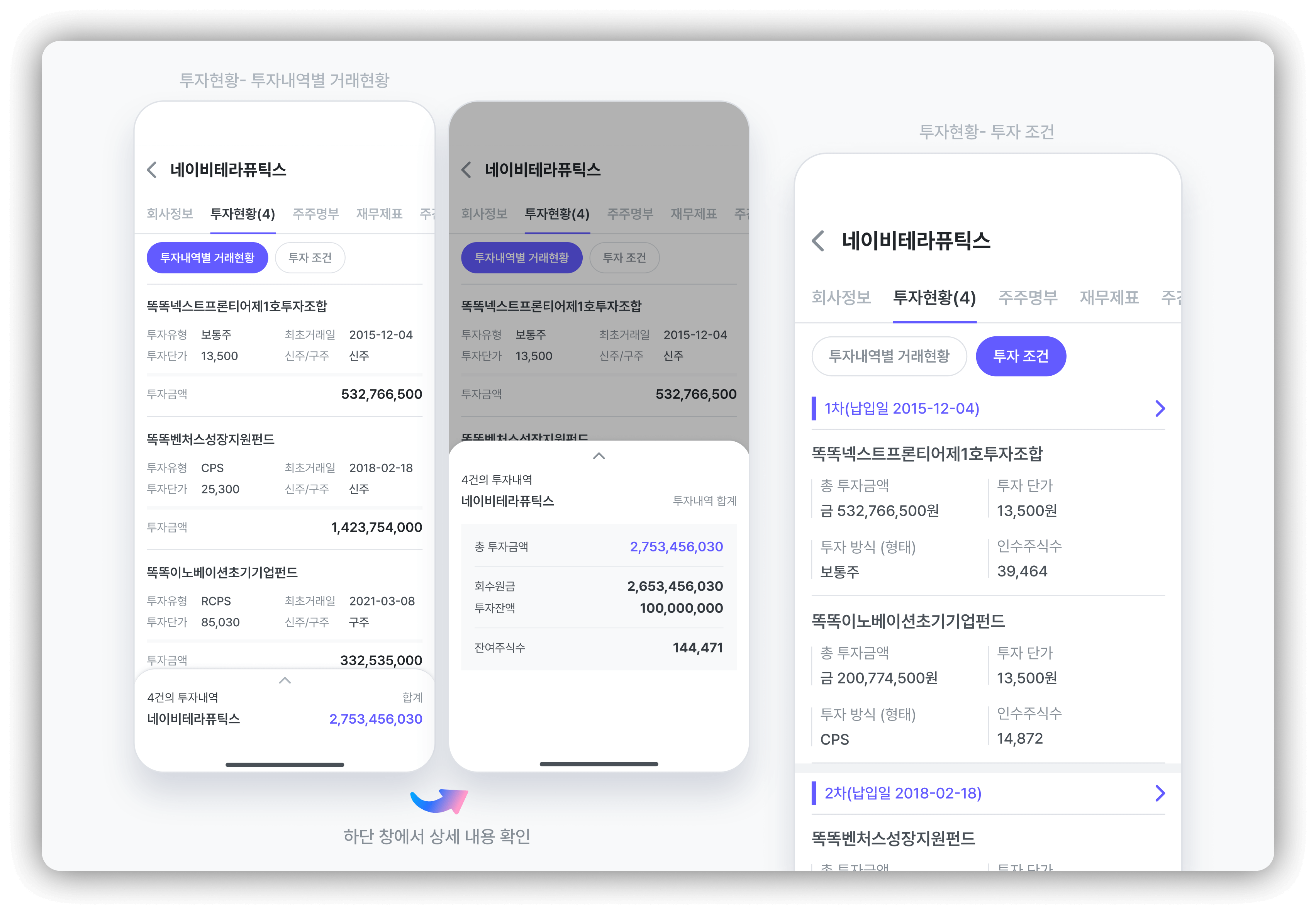

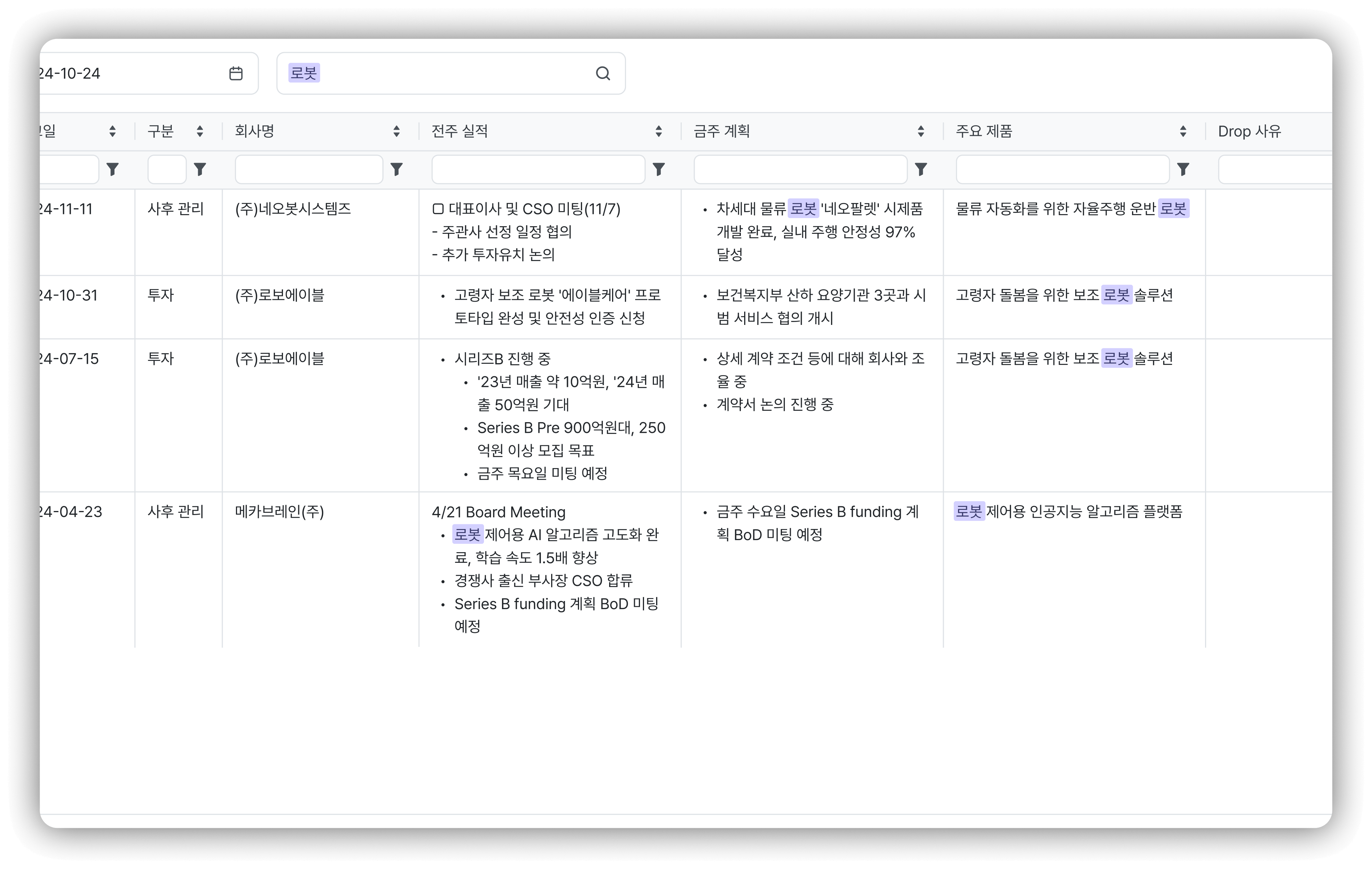

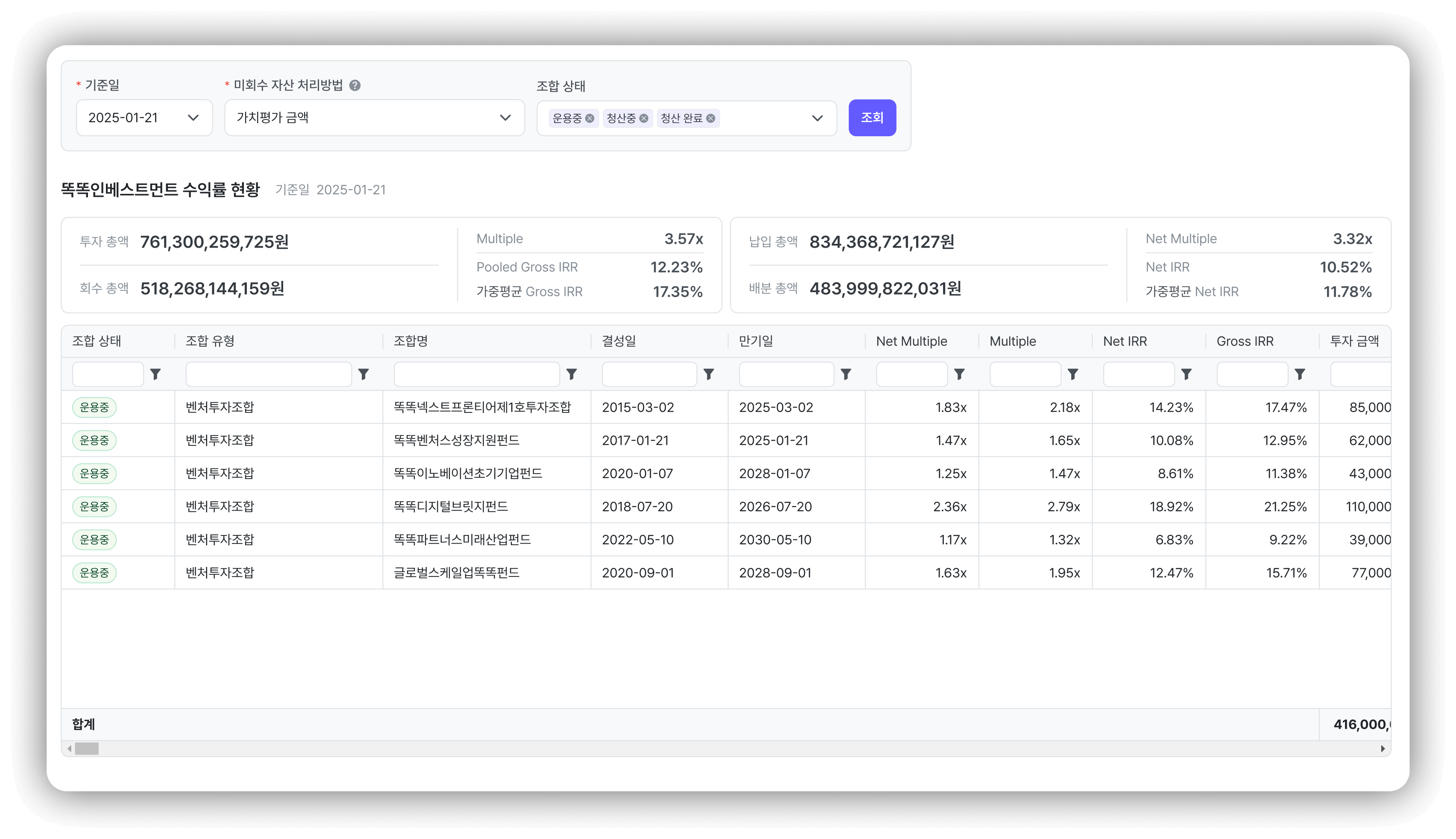

VCworks integrates information flow between ST (startups), VC, and LP into one system.

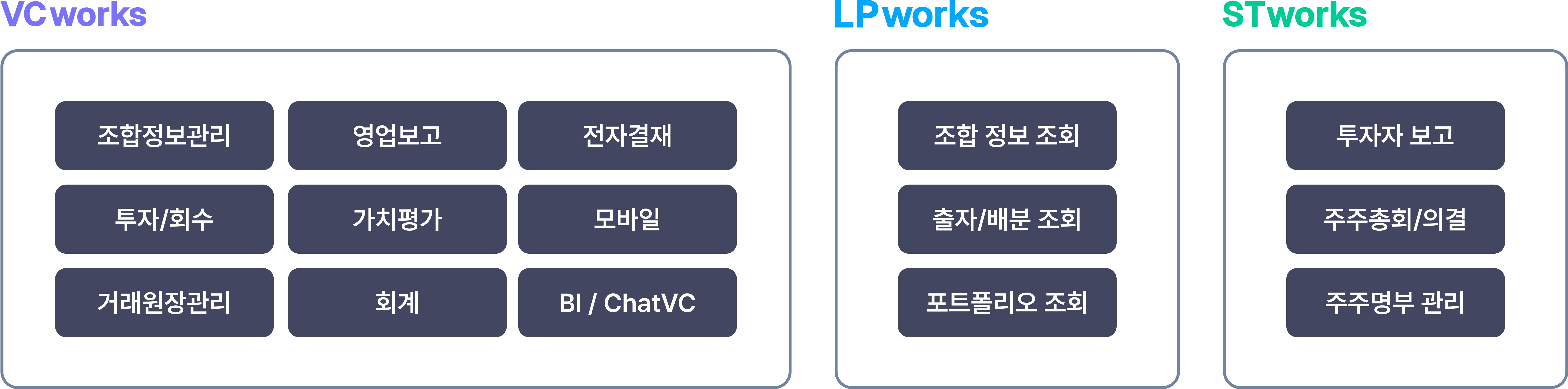

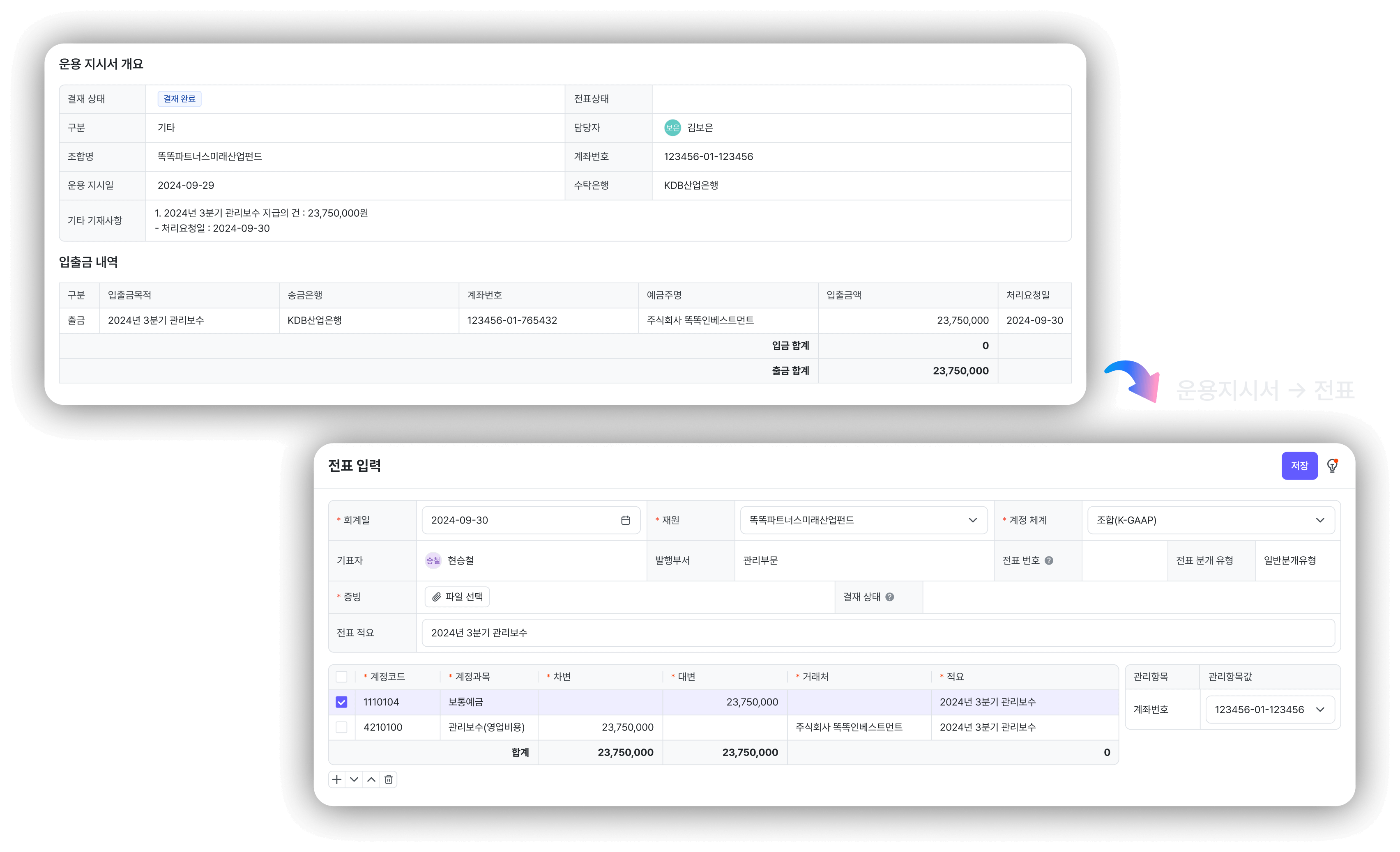

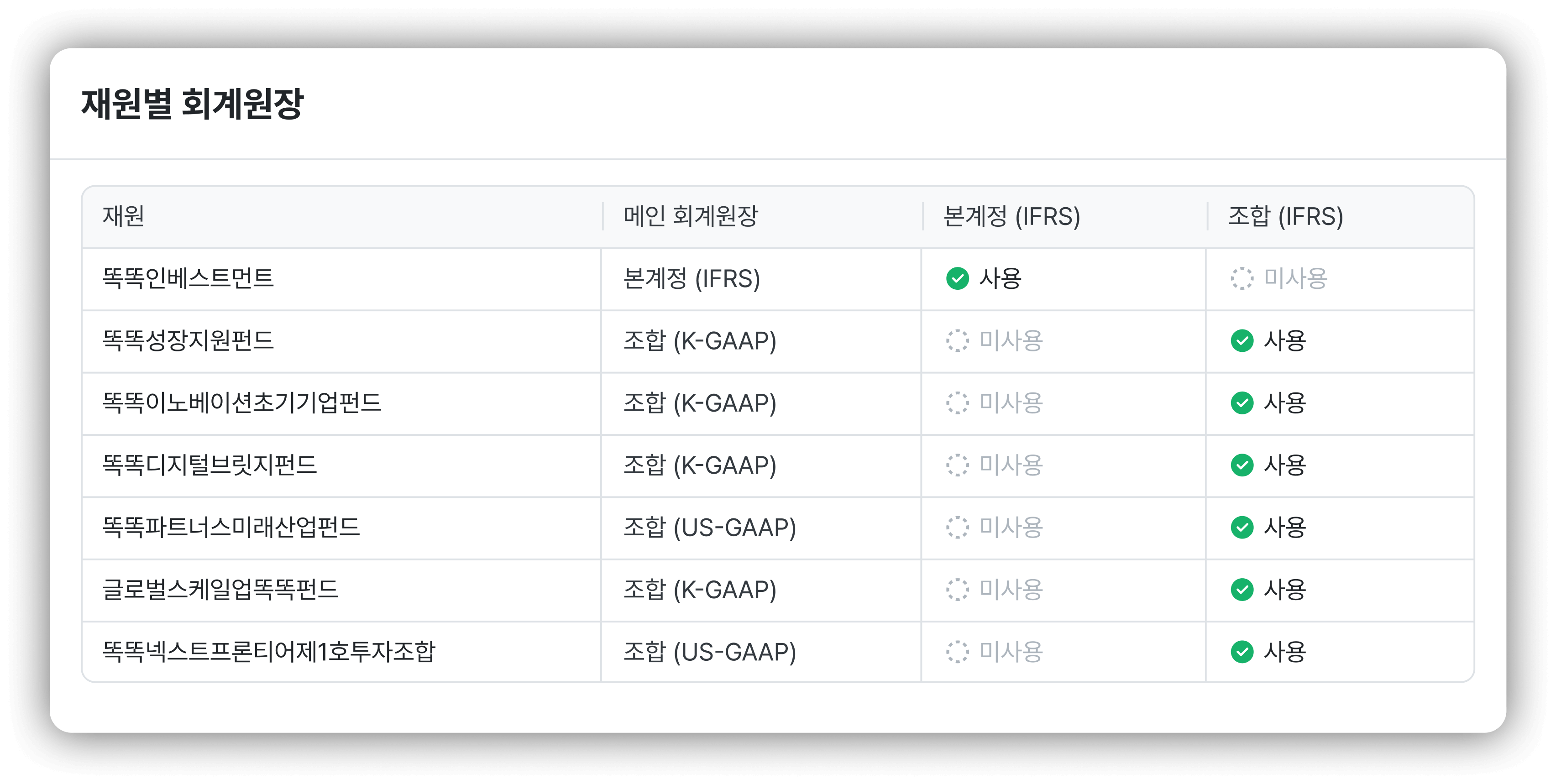

We automate repetitive tasks and design all data to be immediately available for reporting.

The new era of investment asset management starts with VCworks.